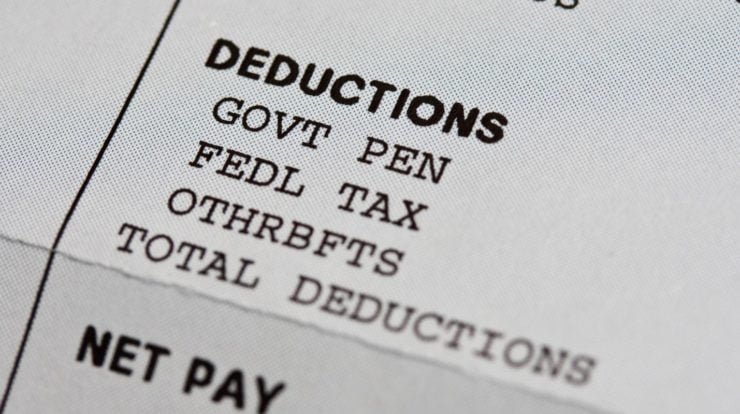

It is vital to understand each detail recorded on your actual check stubs reflect on it. Either you're an employer or employee it's crucial to familiarize yourself with the deductions reflect in your printable pay stubs. You can check your printable pay stubs with the help of free pay stub app.

Image Source Google

So, let us see the necessary reductions which are obtained from your pay. Knowing such deductions enable you to keep conscious of the deduction and the received amount at the end of the month.

Mandatory Deductions in the printable check stubs

Have a look at the reductions from printable pay stubs separately here:

FICA Med tax

It can be probable that you're getting some amounts than he contracted one. In such a situation you should be aware that the FICA includes a commission in your pay.

A predetermined portion of amounts are subtracted from your pay contributed to the Medicare program. This amount is used to conduct the program for the senior citizen who's aged above 65 years. So, whenever you create real check stubs showing this amount will strike you about this kind of deduction.

FICA Social Security tax

Each employee must contribute to the social security program in their cover, which is said under the law. This tax price can be included only when someone reaches retirement age that's allegedly 67 for chiliastic.

State Tax

You've ever noticed the expression state tax in your pay stub that's the amount you need to pay the state authorities. The deduction amount depends upon the state you work in.

It can be possible that you can not observe the state tax deduction amount especially. In such a situation it will be considered that such a condition doesn't require it.

Miscellaneous Deductions

These are the deductions including retirement, cafeteria plan, and health insurance to which you've signed up. In case you've signed up for these miscellaneous things, it's going to be taken into consideration before your taxes and your taxable income can be reduced.